By contrast, the firm with a low margin of safety will start showing losses even after a small reduction in sales volume. A low margin of safety signals a high risk of loss, while a high margin of safety means that the business or investment can withstand crises. The goal is to be safe from risks or losses, that is, to stay above the intrinsic value or breakeven point. Intrinsic value analysis includes estimating growth rates, historical performance and future projections. However, it is less applicable in situations where the business already knows its profitability, such as production and sales.

Get in Touch With a Financial Advisor

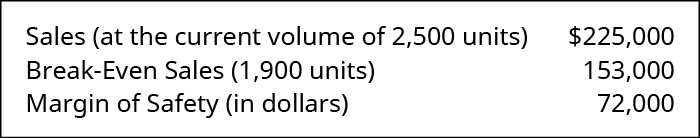

As long as there’s a buffer, by definition the operations are profitable. If the safety margin falls to zero, the operations break even for the period and no profit is realized. The margin of safety ratio shows up the difference between actual and break-even sales and can be used to evaluate a company’s financial strength.

Ask Any Financial Question

You might wonder why the grocery industry is not comparable to other big-box retailers such as hardware or large sporting goods stores. Just like other big-box retailers, the grocery industry has a similar product mix, carrying a vast of number of name brands as well as house brands. The main difference, then, is that the profit margin per dollar of sales (i.e., profitability) is smaller than the typical big-box retailer. Also, the inventory turnover and degree of product spoilage is greater for grocery stores. Overall, while the fixed and variable costs are similar to other big-box retailers, a grocery store must sell vast quantities in order to create enough revenue to cover those costs. Break-even analysis compares income from sales to the fixed costs of doing business.

Part 2: Your Current Nest Egg

As it relates to investing, the purpose of calculating a margin of safety is to give investors a cushion for unexpected losses should their analysis prove to be off. This can be helpful because although estimating the intrinsic value of a stock is supposed to be an objective process, it’s done by humans who can make mistakes or inject their own biases. Even the most experienced and successful traders, both institutional and retail investors — all don’t always make the right call. Margin of safety is a principle of investing in which an investor only purchases securities when their market price is significantly below their intrinsic value.

- In accounting, the margin of safety is a handy financial ratio that’s based on your break-even point.

- In accounting, the margin of safety refers to the difference between actual sales and break-even sales, whereas the degree of operating leverage is a different metric altogether.

- Keeping an eye on outgoings and profit margins is an everyday occurrence for businesses, but it’s important for company accountants to keep a close eye on the margin of safety, too.

- Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

The market value of a stock is simply what price it’s trading for at the moment. This fluctuates constantly and can extend well beyond intrinsic value during times of greed or fall far below intrinsic value during times of fear. Margin of safety is often expressed in percentage, but can also be presented in dollars or in number of units.

Do you own a business?

In accounting, the margin of safety is the difference between actual sales and break-even sales. Managers utilize the margin of safety to know how much sales can decrease before the company or project becomes unprofitable. Upon selling 500 units, the payment of all fixed costs is complete, and the company will report a small business guide to payroll management a net profit or loss of $0. For example, if your margin of safety is around $10,000 but your selling price per unit is $5,000, that means you can only lose a sale of two units before your business is in serious trouble. So, while $10,000 may be a big buffer to some businesses, it may barely be enough for others.

However, if significant seasonal variations in sales volume are involved, then monthly or quarterly computations would not make sense. In such situations, it is advisable to use full year data in computations. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

But Company 2 can only lose 2 sales before they get to the same point. £20,000 is a comfortable margin of safety for Company 1, but is nowhere near enough of a buffer from loss for Company 2. Businesses use this margin of safety calculation to analyse their inventory and consider the security of their products and services. With the idea in mind that a wider or larger margin of safety allows for more room to be wrong about investment choices or analyses, it can be fairly important for investors.

To show this, let’s consider the example of two firms with the same net income shown in their income statement but with a different margin of safety ratio. As shown above, the margin of safety can be expressed as an absolute amount (e.g., $58,325) or as a percentage of sales (e.g., 58.32%). Using the data provided below, calculate the margin of safety for five start-up enterprises.

The margin of safety principle was popularized by famed British-born American investor Benjamin Graham (known as the father of value investing) and his followers, most notably Warren Buffett. Investors utilize both qualitative and quantitative factors, including firm management, governance, industry performance, assets and earnings, to determine a security’s intrinsic value. The market price is then used as the point of comparison to calculate the margin of safety.

Now you’re freed from all the important, but mundane, bookkeeping jobs, you can apply your time and energy to deeper thinking. This means you can dig into your current figures and tweak your business to improve growth into the future. For example, using your margin of safety formulas to predict the risk of new products. Your margin of safety is the difference between your sales and your break-even point. It shows how much revenue you take after deducting all the costs of production.